Factors Affecting Small Businesses in Canada in 2022/2023

Tips and Insights from Attending BC Small Business Networking Events

Welcome back to Blogging the Very Pacific Way. Last week our team attended the Choosing Resilience: Workplace Belonging and Diversity Networking Event in Vancouver, Hosted by Small Business BC (SBBC) & Business Development Bank of Canada (BDC); this year’s theme was Build, Grow, Thrive 2022. Quick fact, 24% of Canadian small businesses originated during the pandemic. This is a testament to the resilience of Canadian Entrepreneurs. We are a polite people, but do not underestimate our ability to thrive in harsh conditions.

Very Pacific Marketing found such value in gaining tips and insights into growing our small business. BDC shared a great presentation on the three main factors affecting Canadian Small Businesses in 2022, unfortunately the outlook won’t be getting much better moving into 2023. We, at Very Pacific, believe in empowering fellow entrepreneurs with knowledge, so in this blog, we would like to share our key take-aways.

What are the Experts Saying Caused Soaring Inflation Rates?

Let’s get into the bad news first, then move into BDC, and other authorities, suggested strategies to mitigate these impacts affecting our Canadian Marketplace. The main challenge affecting our country is the increasing inflation rate – the highest it’s been in four decades.

Canadians living expenses, such as groceries and the cost of fuel can be attributed to the recent hike in inflation. However, experts say various global elements contributed to the high inflation rate, including:

- COVID-19 global supply chain issues and labour shortages

- Russian-Ukrainian crisis

- Low unemployment rate

How are Small Businesses Mitigating the Repercussions of Inflation?

Small businesses across Canada are feeling the current repercussions of inflation. Owners will have to make a tough choice: either deal with loss in revenue or pass the rise in expenses onto their customers via price increases. The majority of small businesses have chosen to increase prices, reported by 52% of Canadian business owners expecting to do so throughout the year.

More than 30% of small business owners are stressed about the impact of inflation on the cost of materials, equipment, and labour, as reported in the 2022 Canadian Entrepreneurs Survey conducted by Ownr. We have already seen those 30% of small business owners surveyed have already raised their prices by over 10%.

What is affecting the Canadian Marketplace 2022 & 2023?

High Inflation & Increasing Interest Rates

In April 2022, Canada’s inflation rate soared to a record-breaking 7.7%, an increase of 6.8% compared to the 2021. As a result, prices have been climbing for Canadians across the board with the purchasing power of our Canadian dollar to drop. As an example, the same grocery cart that cost $100 in 2021 now costs $107.73. That is an increase of almost $80 per $1000 of groceries.

Increased Supply Chain Disruptions

In March 2020 to current, COVID-19 has disrupted the global supply chain and caused labour shortages that have set off a rise in cost-of-living and items like furniture, cars, gas, and food. We may be heading out of the pandemic, but we will feel the ripple affects for some time.

In February 2022, the Russia-Ukraine crisis worsened the supply chain issues by increasing gas, oil, and basic groceries prices. With no end in site to the war, the stability and leveling out of supply chain disruptions remains uncertain.

Increased labour Shortages

Baby boomers are retiring and a sharp decline in immigration during the pandemic have also added to the increased labour shortage in the province.

Reported in April 2022, the unemployment rate dropped to a record low. Normally is a good thing, the Phillips Curve in economics theorizes that lower unemployment means more money in consumer pockets, meaning they spend more, leading to an upward price trend.

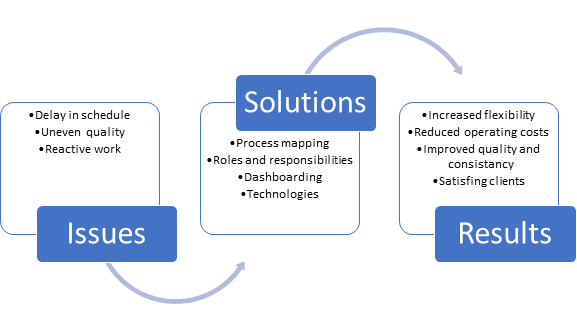

What the Experts Suggest Small Businesses Do to Mitigate these Factors

Revert back to your Business Plan; big tip, this plan should not be considered static. There are components that have changed over time, your business has and will need to change over time to remain competitive. How have things changed for your business? Does your original analysis still apply?

Suggested Strategies to Fight Inflation

- Reinvest your Profits – Invest in automation and digital

- Protect Your Profit Margin – Analyze your inputs, supplies, product quality

- Review your Service/ Product offering – Lower margin on products – Discontinue or Change

- Increase Efficiency – Focus on the customer and the employee – it’s easier to keep a customer than gain a new one

Suggested Strategies to Fight Supply Chain Disruptions

- Invest in digital – Automate and digitize your operations

- Increase inventory quantities – Order more, focus on best sellers

- Diversify your suppliers – Source local, different countries

- Communicate with your employees, suppliers and customers – Audit your system, find out what’s working and what isn’t

Suggested Strategies to Overcome Labour Shortages

- Automate/ Digitize Tasks – Invest in technologies

- Train People at all Levels – Make Training an Ongoing Process

- Provide Context Around Why Policies and Processes Change

- Build Better Teams Through Better Communication

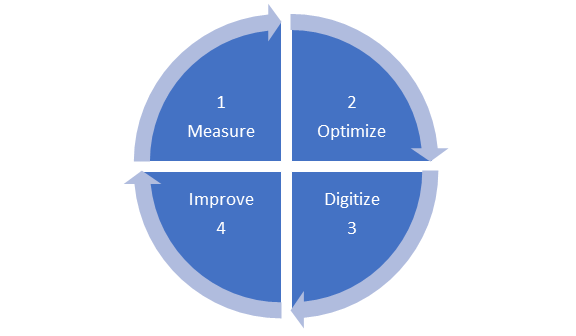

BDC indicated companies that took their suggestions to combat these factors affecting small business did better in productivity and say better profit margins, as indicated in the chart I recreated below.

|

Percentage of Improvement in Business Productivity |

||

|

Implementation of BDC Recommended Strategies |

Companies That Did Not |

Companies That Did |

|

Fight Inflation |

30% |

61% |

|

Over Come Labour Shortages |

40% |

58% |

|

Reduce Supply Chain Issues |

28% |

42% |

Key Take-Aways to Improve Small Business

Our 4 Key take-aways from this event are to 1. Revisit Your Business/Marketing Plan, 2. Analyze, 3. Streamline, 4. Outsource – the overall theme is to Invest in Digital Technologies/Services.

- Compare your revenue and profits per employee against your competitors; you can use a free tool on the BDC website ca/performancebenchmarking.

- Identify forms of waste; focus on the ones that impact your productivity the most. (Overproduction, Waiting, Transport, Inefficient Operations, Inventory, Motion, Non-quality, Poor Design)

- Map your processes; this will allow you to see how they really are. (Theoretical – “How you think it works”, Actual – “How it actually wors”, Optimal – “How it should work”)

- Optimize business processes; look at what it involves exactly. Automate repetitive tasks to free up effort for value added tasks.

Companies that adopt digital technologies see real benefits; 60% boosted their productivity, 50% reduced operating costs and 42% improved overall product quality. Very Pacific Marketing is here to help you in may ways. We can improve your overall marketing strategy and assist in your marketing research. Our success is in seeing your business grow and thrive in the online Marketplace.